[GUEST POST] Budget it

Introduction

‘Budget It’ is a game where players experience a month as a person earning $2.3k in Singapore. They are met with many different scenarios and tough financial choices that they will have to make.

Brainstorming

Money is a topic that I find interesting due to its importance in our lives. Everyone knows that being thrifty and spending wisely is beneficial but when we don’t feel the scarcity of money, we don’t feel the true significance of it.

Hence, when told to think of a game that allows players to have meaningful takeaways from it, I chose the importance of money as my topic. This game, inspired by Bitlife, throws them tough decisions that they will have to make, testing their spending habits and allowing them to feel the struggle of being short on money.

Desired outcome

The desired outcome is for the players to understand the large role money plays in our lives affecting areas that don’t appear to be tied to finances, for them to understand the unpredictability of pitfalls in the initial budgeting plan and to learn more about the different costs of living in Singapore. I also wanted them to feel for those who are not in a financially strong position and to make the player better equipped to handle money.

Flow of game

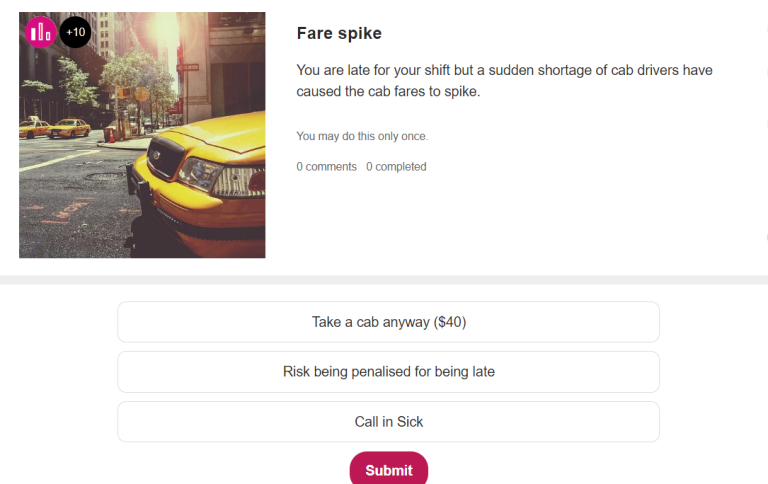

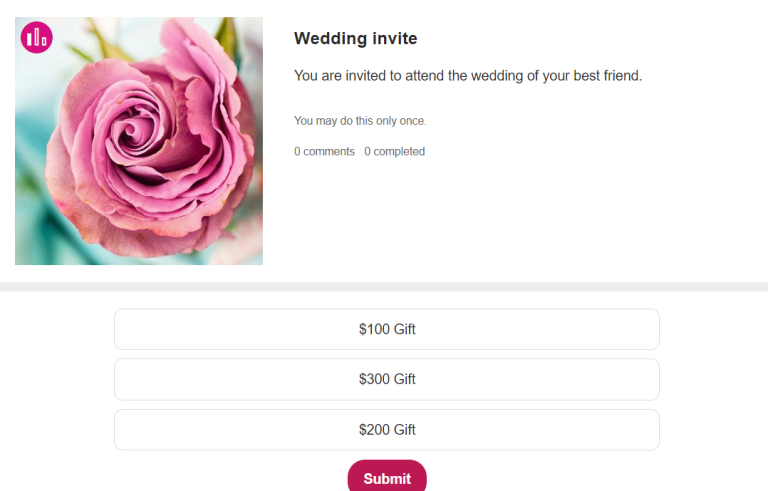

In the game, the player has to make purchase decisions with only an income of $2.3k per month. The player needs to cover everything from their rent, meals and outing costs that will appear in the form of challenges. The challenges that the players are faced with can be categorized into four different groups – the unpredictable, basic, social and miscellaneous – each of the categories aiming to spark a certain realization or emotion in the player.

The unpredictable group presents costs that are impossible to avoid. This is to show how there are many unexpected obstacles in the world of budgeting and to show how unavoidable costs often derails the budgeting plan.

The basic category allows players to understand more about the basic costs of living in Singapore, from paying rent to basic grocery items.

The link category shows how money is interlinked to the different areas of one’s life, including their social life and moral compass. It gives the players a chance to feel a sense of disconnect from their social circle and their moral standpoint when money is tight, encouraging them to understand the value of money.

The miscellaneous aims to strengthen the player’s financial literacy by introducing the concept of “needs” vs “wants” as well as the concepts of scams so that players will be more aware of it and will be better prepared to handle it.

As an extension to my game, I also created a personality quiz for the players to find out “what kind of spender are you?” The quiz is a self discovery tool where players can better understand their spending habits and from there decide if or how they would like to change.

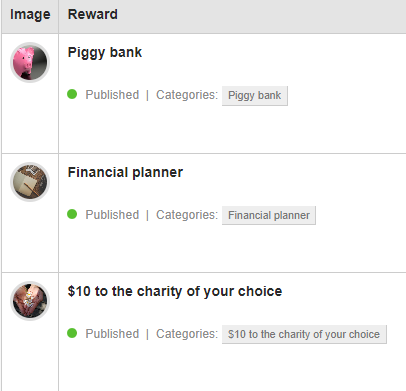

Rewards

To incentivise the players to successfully complete the game, the players are able to redeem rewards upon successful completion of the game. Prizes include financial planners and piggy banks to serve as a material motivator, as well as the ability to donate $10 to any charity of their choice to tap on the player’s altruism. I was inspired by the projects of one of my seniors to make the donation a reward and decided to implement it as well.

Features of the game

To make the game more engaging, I incorporated a few gamification elements within it. The uncertainty of making it through the month successfully played on the element of loss and avoidance, the rewards played on the element of development and accomplishment, and the messages shown to the players after every challenge plays on the empowerment of feedback.

Challenges

The first challenge was to find the scenarios and challenge formatting that would best suit my game. A long period of research, trial and error and brainstorming was required for me to achieve the diversity and intensity of responses that I wanted.

Another challenge was the limitations of the platform. Initially, I wanted my game to include concepts such as passive and non-passive income so that the player can have full control over their money. However, the platform did not have a function to deduct points and I could not have the “wallet” feature as I had initially wanted. Therefore, I had to limit my game to a one-way transaction. I decided to focus on the expenses instead of income as I felt that it was an easier concept to be brought out in a game. Although this was not my original plan, it made my game a lot more targeted and in depth which benefited the game as a whole. My game did not use the conventional layout of games on the platform as the aim of the game was to get as few points as possible. This created some issues in the creation of achievements and rewards. However with the assistance of my mentors I managed to overcome this by turning achievements into warnings and having only the admin be able to give rewards.

Conclusion

Through creating this game, I learnt how to focus on key aspects of the game instead of making the game very fancy to allow players to easily achieve the desired outcome. I also learnt to think outside the box to make the best use of the different challenge modes to make the game as engaging for the players as possible. In the modern world, money management is becoming more important than ever before but it’s not always a very fun concept to handle. I feel that the potential for gamification in learning especially is limitless and when used well, it will make the learning experience a lot more enjoyable and smooth for the learner.

Go check out my game!