Revenue Management for the SaaS Industry

If you’re reading this off a computer screen, chances are you rely on some version of the Microsoft Office suite during work to produce reports (Microsoft Word), presentations (Microsoft Powerpoint), and spreadsheets (Microsoft Excel). We buy this software package for a one-time fee, install it to our computer, and it’s ours to keep.

However, in 2013 Microsoft came up with a new offering: Office 365. Instead of the one-time fee, users now have to pay a monthly/yearly subscription, essentially renting the software. Sounds crazy to pay monthly fees for something you could own by buying a CD, right?

As an individual, the notion of “renting software” might be rather foreign. The pricing for Office 365 might be off-putting, as one would rather pay a single flat fee now, than receive credit card bills monthly into the indefinite future. On the other hand, Office 365 is likely to see more frequent releases of new features and updates compared to the traditional Office Suite.

An Introduction to the SaaS Industry

Whatever your views are towards its application to consumer software, the business model of “renting software” has already been proven in the enterprise software industry. The name for this business model is Software as a Service, or SaaS for short. The Wikipedia page for SaaS gives us the following definition: “Software as a Service (SaaS) is a software licensing and delivery model in which software is licensed on a subscription basis and is centrally hosted.”

Confused? Here is a brief explanation of how it typically works:

- The software developed by the SaaS company is installed on a central platform, like how Office 2016 is installed on your computer. (This platform could be a group of servers physically located in the SaaS company or server capacity rented from a cloud computing vendor.)

- The user gets the right to use the software by paying software licensing fees to the SaaS company. Using the Internet, the user accesses the software which is hosted on the central platform. This licensing agreement works like your phone bill, in that you pay a monthly fee to access the telephone network.

The SaaS model was popularized by customer relationship management (CRM) software such as Salesforce and expanded into other types of business software. As opposed to traditional software licensing models where enterprises signed vendor contracts for multimillion-dollar implementations, under SaaS the enterprise “rents” the software from the SaaS vendor for a monthly fee, allowing the enterprise to replace huge fixed costs with recurring variable costs. Global spending on SaaS by businesses for various purposes is predicted to grow from USD $87 billion in 2015 to $106 billion in 2016 as depicted below, a testament to the effectiveness of the model.

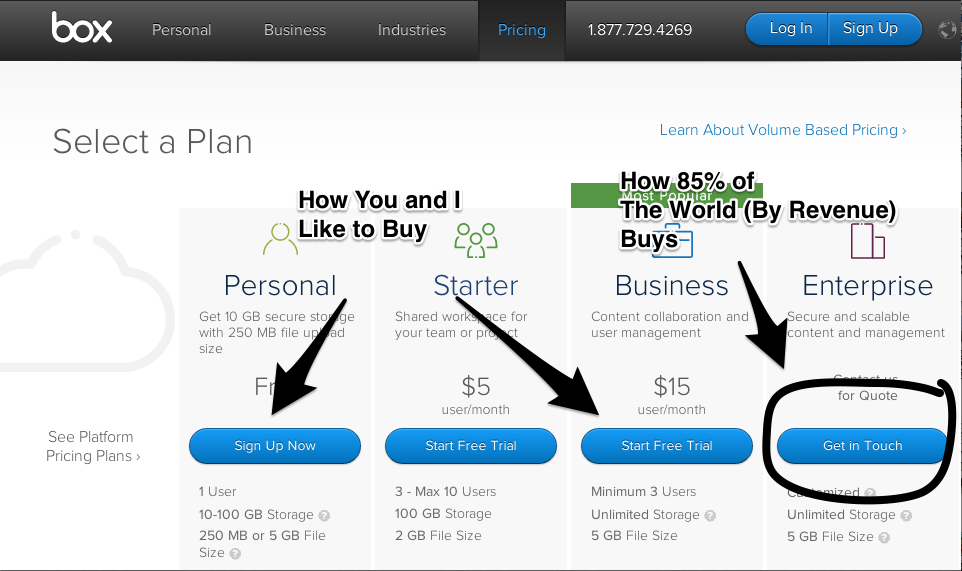

In the SaaS industry, pricing varies a lot. Although some SaaS companies may show their pricing details on their website, SaaS expert Jason Lemkin states that the majority of revenue in this industry is comprised of deals that are negotiated privately. This breakdown is illustrated in the screenshot below. An average such deal provides annual revenues of six-figures and above.

Of course, there are well-known SaaS companies that earn most of their revenue from small subscription fees such as DropBox (USD $15/mth) and SurveyMonkey (SGD $50/mth), but these are the outliers. In this analysis, we will be examining the typical SaaS company that earns its revenues off large enterprise deals.

The Necessary Conditions for Revenue Management

Revenue management, the prediction of consumer behavior to optimize product availability and price for maximum revenue growth, was first adopted in the airline, hospitality and car rental industries. We shall now discuss why this concept is applicable to the SaaS industry by looking at six necessary conditions (Kimes, 1989):

- Relatively fixed capacity

- Perishable inventory

- High fixed costs, low variable costs

- Inventoried demand

- Time-variable demand

- Varying customer price sensitivity

From the average consumer’s perspective, the software industry seems to have unlimited capacity, as the process of creating an additional copy of the software is as easy as copying-and-pasting the installation file.

However, for a typical SaaS company, the work they are able to take on is limited by two factors: their central platform’s capacity and their staff headcount. As established earlier, since their customers access the software from the central platform over the Internet, the number of customers serviceable is limited by this platform’s capacity. More technical details on server capacity metrics and calculations may be found here. Staff headcount is a limiting factor since in these SaaS enterprise deals, there is a service component involved (usually 15-20% of the contract value), and every such deal consumes a non-negligible amount of man-hours. Thus we see that there is relatively fixed capacity in SaaS.

As subscription services are unable to be stockpiled, and the two limiting inputs of server capacity and man-hours cannot be accumulated over time, the condition of perishable inventory is satisfied. High fixed costs and low variable costs are a characteristic of any firm in the software industry. Demand can be considered to be inventoried due to the length of the enterprise sales process (3-6 months); a deal in the negotiating stage or a contract that is signed before any system usage occurs, is similar to a reservation or a customer on a waiting list. The demand is time-variable due to certain trends, e.g. enterprise customers have budgets that expire at the end of the fiscal year and spend more during that period. (In fact, one study shows that US federal government spending in the last week of the year is 4.9 times higher than the rest of the year’s weekly average) Last but not least, customer price sensitivity varies based on the particular enterprises’ needs, e.g. a large corporation that has thousands of employees would be willing to spend more on a content management system (CMS) to use in its employee training program as compared to a medium-sized business with only 200 workers.

Revenue Management as applied in SaaS

Having established that revenue management (RM) is applicable to the SaaS industry, we proceed to discuss the RM methods that see application. With their revenue mainly coming from enterprise deals, the main way SaaS companies can apply RM techniques is through pricing, specifically applying price discrimination to maximize revenue. Indeed, pricing is identified as one of two key strategic levers used by companies for RM (Kimes & Chase, 1998). In practice, no two enterprise deals are the same, hence it seems reasonable that the SaaS company would charge different prices for each individual deal.

This price discrimination is supported with physical rate fences and non-physical rate fences (Dolan & Simon, 1996; Kimes & Wirtz, 2003). These rate “fences” are rules that prevent customers paying a higher rate from trading down to lower prices.

Physical (or product-related) rate fences include:

- A Variable Component: This is usually based on the number of users, volume of usage (transactions, messages, storage), number of servers, or number of accesses to a network. With this fence, enterprises with large number of users (their employees) usually have no choice but to pay a higher subscription rate. Example: Salesforce Performance Edition at USD$300/user/month

- Bundling of Modules: Business software typically comes in modules that offer different functions or address different needs, even if these modules all operate on the same platform. Enterprise customers require different “bundles” for their companies’ specific needs, allowing the SaaS vendor to price differently for the sum of these parts. Example: Zoho’s variety of mobile apps

- Bundling of Services: Customers may be allowed to select the level of service and support received. The SaaS vendor can provide different levels of service and support separately from the right to use the software, with large enterprises typically preferring high levels of service and support due to the change management involved in adopting new software. Example: Netsuite’s services

- Customization: Enterprise customers may require customization of the software package. While this is not ideal in SaaS, as any changes made on the central platform will affect the software used by all other customers, the SaaS company may choose to work these customizations into their development schedule as new features, or set up a separate instance for customers with specific needs, or other technical workarounds. Of course, customers that require customization would see accordingly larger contracts. Example: Zendesk’s Professional plan offering “custom private apps”

Non-physical rate fences include:

- Controlled Availability: This is the availability of certain discounted rates to particular market segments. Example: Nonprofits receive free access to LinkedIn Talent Finder plan

- Customer Characteristics (Special Price Tiers): Special price tiers arise due to unique circumstances not listed in the physical fences above, such as the need to acquire a strategically important customer, or unique characteristics of a sector that the customer operates in. Some may appear in the form of unlimited licenses, or revenue-sharing agreements. No examples here, as information for these types of deals would not be made public, but these are likely to involve either large deal sizes or strategic discounts.

- Transaction Characteristics: This involves charging different prices based on the structure/process of the transaction itself, such as customers being able to buy subscriptions at lower rates from channel partners who in turn generate lots of revenue for the SaaS company. Price could also differ based on the frequency of the payment stream Example: Gametize’s monthly rate is USD $100 while the annual rate is USD $1000

- Product Line: SaaS companies differentiate their services by listing different subscription packages on their website to appeal to different market segments (often the lower price tiers). This is similar to the fences of module bundles and service bundles; however, the product line is displayed publicly whereas the bundling is negotiated privately. Example: Basecamp’s 3 simple packages

Apart from pricing, other considerations in revenue management involve the other four of the “5Ps of marketing”: Product, Promotion, Placement, and People.

RM concerns with regard to the product, the SaaS software, would be the technical work required to implement the physical rate fences as described above (e.g. ensuring that a customer on a lower tier subscription plan cannot access a feature they did not purchase).

As for “promotion”, proper pricing communication is key to execute RM in SaaS. As stated earlier, SaaS companies publicly disclose pricing at lower tiers, as this is where competition and commoditization drive prices down to similar levels among all competitors. Few SaaS companies fully disclose their pricing despite being able to reduce sales and marketing costs through doing so. Similarly, few companies are public about their discounting and price negotiation policies. Majority of SaaS companies adopt opaque pricing policies since a full-disclosure pricing policy becomes unwieldy when discounting gets involved. As the deal size/annual contract value (ACV) increases, at some point discounting becomes expected rather than a bonus. Many SaaS customers expect some level of discount when a long-term contract is signed, or a larger subscription package is chosen.

Implementing RM for “place” (or distribution) involves making it as easy as possible for a potential customer to get to know of the SaaS product and purchase a subscription. This involves online marketing techniques like advertising and search engine optimization (SEO) such that the SaaS company is featured prominently to their target customer. The SaaS company would also aim to streamline the subscription and payment process as much as possible, using services such as PayPal and e-invoicing.

For “people”, the scope of work of the sales and marketing staff in a SaaS company is arguably determined by the average size of a deal (ACV), due to the economics involved. The following table illustrates the supportable sales & marketing activities at each price level, and is likely to be of interest to people working/planning to work for a firm in this industry.

Average Annual Contract Value (USD) | Supportable Sales & Marketing Activities |

$60 – $1,000 | Limited to Freemium/Viral marketing models. Unable to support 1-on-1 marketing or full-time sales rep. |

$1,000 – $5,000 | Previous tier + Inside Sales team, limited 1-on-1 marketing. Limited to low marketing costs per lead. |

| $5,000 – $20,000 | Previous tiers + Field sales, increased cost-per-lead, prospecting and outbound sales |

| $20,000+ | Previous tiers + Ability to spend four-figure amounts to acquire customers, frequent overseas sales meetings |

*Table adapted from “A Little Less About Pricing. A Little More About Deal Size. Please.” by Jason Lemkin

Having discussed how revenues are earned and maximized in the SaaS industry, what do you think about the characteristics of this field and these tactics that are used to achieve revenue growth? Please feel free to leave your questions and/or comments on this article.